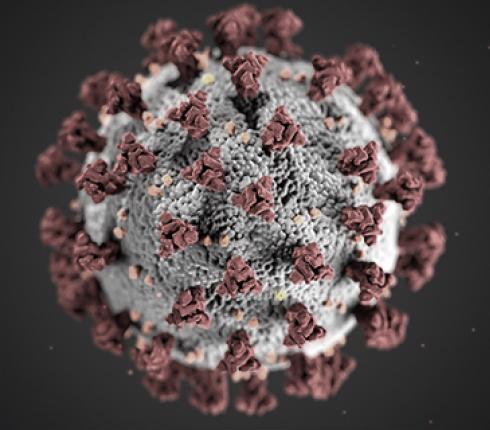

The Danish Parliament has passed a law on salary compensation in connection with COVID-19

COVID-19 greatly influences the Danish labour market and raises a wide range of issues within HR and employment law as well. Below, we explain the newly passed salary compensation scheme.

On 24 March 2020, the Danish Parliament passed the law on salary compensation for companies in connection with COVID-19 - commonly referred to as the "salary compensation package".

The law provides us answers to the two questions that we at NJORD have been met with the most:

- whether companies - prior to joining the compensation scheme - can enter into mutual agreements with employees on salary reductions, and

- whether companies that already have laid off employees may subsequently enter into the scheme.

With this newsletter we hope that you will be able to have your questions to the new law on salary compensation answered in an easy and clear way. If you cannot find an answer to your specific question below, please contact us at ansaettelsesret@njordlaw.com. We are ready to advise on all employment consequences associated with COVID-19 and the latest actions taken by the Government.

Who can use the scheme?

- All private companies facing the need to notify redundancies for a minimum of 30 % of the workforce or more than 50 employees.

- Associations, foundations and self-governing institutions are covered by the scheme if they receive less than half of the institutions' ordinary operating expenses in government grants.

- It is a requirement that the company is registered with the Danish Business Authority (CVR) and that employees who want to be covered by the salary compensation scheme have a Danish Social Security Number (CPR-no.)

What does the scheme entail?

The salary compensation period starts when the first employee is sent home and ends on the day, the company notifies of or dismisses employees for financial reasons.

Companies may join the scheme even though they have made redundancies for financial reasons prior to joining, but no salary compensation can be provided for prior dismissed employees, even if they continue to work for the company during their notice period.

In principle, the companies may only apply for salary compensation once during the period 9 March to 9 June, but if in need of sending more employees home than applied for in the first application, another application may be submitted.

The salary compensation constitutes 75 % of the total salary expenses for the employees covered by the gross salary on a monthly basis, but a maximum of DKK 23,000 per month per full-time salaried employee. For other employees, salary compensation may amount to 90 %, but a maximum of DKK 26,000 per month per full-time employee.

Sending home - and recalling to work - employees can be made by 1 day notice.

The company can recall employees at any time should the work tasks come back. In that case, salary compensation will cease. If the company only needs to recall some of its employees to work, it is presumed that salary compensation can be maintained for the employees that continues to be at home, as long as the minimum requirements for this are met, i.e. at least 30 % of all employees or at least 50 employees remain sent home.

What are the conditions for using the scheme?

In order to use the scheme, the company must refrain from using any options for sending employees home without full salary. Therefore, the scheme may not be combined with an agreement on e.g. work-sharing.

The company must continue to pay full salary to employees during the compensation period. The dismissal-threatened employees must not work but must be sent home during the period with full pay.

The individual employee for whom the company seeks salary compensation must take vacation, and/or time-in-lieu of a total of 5 days during the compensation period. If the employee does not have holidays, time-in-lieu, etc. corresponding to 5 days, the employee will be sent on leave without pay or be using days from the new holiday year. It will not be possible to receive salary compensation for these 5 days.

The days must be proportionately calculated for the period, during which the employee is at home. For example, if an employee is sent home for 1.5 months, it will amount to 50 % of the period (as the maximum period is 3 months), and the days off amounts to 2.5 days.

Days already taken before the agreement was adopted but after 9 March 2020, can be included in the application.

If the repatriation is interrupted - because the employee resumes work or ends his/her employment, the employee re-enters his/her normal terms of employment.

When the Danish Business Authority checks if conditions are met, it is based on the company’s registration number (CVR-no) and not an individual production number (P-number)

May salary cut agreements be made before the company joins the scheme?

Yes, the salary compensation scheme can also be used where there is local agreement on salary cuts. In that case, it is the reduced salary that is used in the salary compensation scheme. It is a condition that the salary has been changed before the company joins the scheme.

It should be emphasized that such an agreement must comply with the framework of any applicable collective agreements and that the agreement must also be voluntarily concluded.

In areas where the employees have elected a union representative or spokesperson, this person may make salary reduction agreements on behalf of the represented group.

Companies which have agreed on salary cuts, receive salary compensation throughout the entire compensated period, and the companies are not deducted for up to 5 days during this compensation period. Thus, the employee shall not take up to 5 days off or other freedom at his/her own expense during the salary-compensating period.

Can the company dismiss employees prior to joining the scheme?

Companies may enter the salary compensation scheme even if they have made redundancies prior to joining the scheme due to COVID-19/financial reasons.

In this case, no salary compensation is granted to employees who have already been laid off, even if they still work in the company during their notice period.

There is no requirement that a specific time period shall pass between redundancies and an application to be included in the salary compensation scheme.

The salary compensation is conditional upon the company not dismissing employees for financial reasons during the salary compensation period. If the company later must dismiss employees, the scheme would therefore end for the entire company, but only for future course. The company does not have to repay already received compensation covering until the date of exiting the scheme.

What documentation requirements must be met in order to be covered by the scheme?

Companies must apply for salary compensation with the Danish Business Authority.

The salary compensation is paid based on the company's information on the number of employees who would otherwise be laid off as a result of the COVID-19 situation but who are instead sent home.

The information to be submitted must include, inter alia: the employment rate of the employees, the salary of the employees, the period of repatriation and a sworn statement of the authenticity of the information submitted.

The company must state and justify the period for which they expect a shortage of work, though for a maximum of a period of three months commencing no earlier than 9 March 2020 and ending no later than 9 June 2020.

In the application and subsequent audit, the employees must be registered by their Social Security Number (CPR-no.).

Upon payment of salary compensation, the company must document the employees' salary level, that the employees were employed before 9 March 2020 and that the company has sent home the said employees during the specified time period. The documentation shall include a signed certificate from any union representative that the employees in question have been sent home. If no such union representative exists at the workplace, the relevant labour unions may object, if they do not find the documentation correct.

In addition, the Danish Business Authority can require every company to use auditor assistance. The requirement for audit assistance may be made according to various criteria e.g. spot check, size of compensation, risk assessment, etc. In addition, auditor assistance may be required in relation to documentation already submitted.